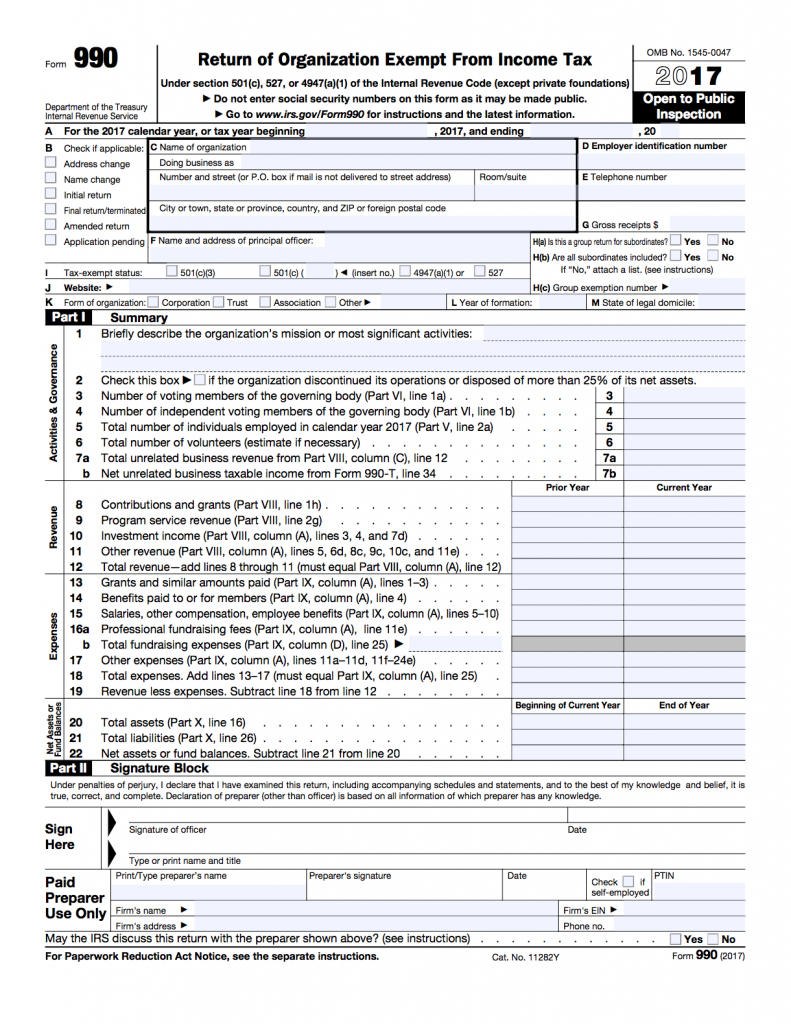

Unlike consumer credit reports, which have more robust privacy protections, almost anyone can check a business’ credit report. The company’s payroll or accounting department might be a good place to submit your request, though there’s no guarantee a business will be willing to share those details. Here are a few potential ways you might be able to find a business’ EIN when you need it:

Ein look up search verification#

There may come a time when you need to look up another company’s EIN for verification purposes, risk assessment or other reasons. The department is open Monday through Friday between 7:00 am and 7:00 pm local time. You can reach out to the Business and Specialty Tax line by calling 80. Call the IRSĪ third way to look up your EIN is to call the IRS.

Ein look up search license#

The IRS also suggests that you might be able to get a copy of your EIN by contacting institutions with which you shared that information in the past such as your business bank or local and state business license agencies. Or you might look over old financing documents, like applications for business loans or lines of credit. For example, you might want to take a look at previously filed tax returns. Check Other Places Your EIN May Be RecordedĪside from confirmation letters from the IRS, you may be able to find a copy of your EIN on other important documents. You or whoever helped you apply may have saved a copy of it for future reference. Look back through your paper and digital business files. Depending on how you apply, you may receive a confirmation letter with your EIN online at the time it was issued or via mail or email.

The IRS will notify you when it approves your EIN application. If you previously applied for an EIN and have forgotten it, here are a few possible ways to look up your business tax ID number.

0 kommentar(er)

0 kommentar(er)